2021-05-21

For a few days now, we have been experiencing a veritable "bloodbath" of prices on crypto exchanges, such as Coinbase worldwide. Across all cryptocurrencies, prices have plummeted between 30-60%. At this point, we would like to briefly show you why panic selling has led to this price collapse and why we believe that this can be completely exaggerated and even healthy for the further development.

First, Elon Musk announced via tweet that his e-car company Tesla will no longer accept Bitcoin payments after all. He cited the high energy consumption of Bitcoin as the reason, saying it was too harmful to the environment. He also wrote tweets that leave a lot of room for interpretation, one point being that Tesla could possibly sell Bitcoin stocks. This announcement alone and speculation in the press brought so much uncertainty to the markets that quite a few put their cryptocurrencies up for sale. This resulted in massive price losses (in some cases 20% and more)....

However, after heavy criticism from financial experts and especially the Bitcoin community, Elon Musk clarified that he himself had not sold and that Tesla had also still kept all Bitcoin holdings. Yes you read correctly, he himself did not sell!

We would like to pose a question at this point: How can Elon Musk claim that Bitcoin's energy consumption is too high and too harmful to the environment but in the same breath own a space company (SpaceX) that burns many times more energy in the form of fuel to launch into the atmosphere. And let's stay with his company Tesla itself, where does all the electricity for his e-cars come from, in the production of the car and its components and of course then to be driven? Do you think it is 100% green or renewable? In our eyes, Elon Musk is a hypocrite.

When the storm around Elon Musk's posts died down a bit and the crypto market took a breath for a day the next comeuppance came, this time from big governments, it was once again about the "never-ending story" of regulating crypto markets. What a coincidence that people took advantage of the market weakness to now blow this horn again. In addition to the attempted regulation by the countries of China and India, this time there was a new proposal being considered by the United States. Consequently, US President Joe Biden has announced that in the future, all transfers worth $10,000 or more will be reportable to the US IRS. This is reported by The Verge.

As a reason, Joe Biden cites here (as already several times in the past) illegal activities (as if no criminal activities were taking place in the dollar system), including tax evasion, which are related to cryptocurrencies, these are to be stopped. Biden's proposal therefore provides additional resources for the IRS.

Continuing with governments, we would also like to briefly introduce China's new stricter course. The central government in Beijing announced almost simultaneously with the U.S. that it wants to take even tougher action against mining and trading. In doing so, China wants to protect the financial system, according to Chinese Vice Premier Liu He and the State Council, CNBC reports.

Ordinary citizens, who have little knowledge of the monetary and financial system, will certainly welcome and perhaps even celebrate the announcements. Sure, at first glance their governments are selling more security against criminal activities or additional tax revenue for the general public. But if you take a look behind the scenes, it quickly becomes clear to a neutral and well-informed observer what is really being played here. They want control, not immediately but insidiously...

The governments want to protect their own currencies with all their might, because they are currently working on their own digital currencies, a kind of currency 2.0. What we are currently experiencing all over the world is a completely escalating debt system of our current monetary system (FIAT money). With the pretext of the pandemic, all states around the globe are making more and more debts faster and faster. The central banks print more and more new money, inflation starts to build up, which brings a huge devaluation of the purchasing power of money.

People who have seen through this spectacle are fleeing the old monetary system and buying tangible assets limited by mathematics. These are, for example, real estate, works of art, Bitcoin but also gold, silver and land. And this is exactly where the politicians must now step in, because they still have to bridge the time until their own digital currencies are mature. China is about to launch the digital yuan here, and tests are already underway in smaller model regions. But compared to Bitcoin, the government's digital currencies are centrally controlled, not decentralized! That is the big difference, thus the state can always control the money supply. And the state can then siphon off much more information, because with the help of digitization, a currency can then be given an expiration date, every movement of money and every purchase can be tracked, and you can shut down access to money at any time, for example in the case of anti-government opinions. The goal here is the abolition of cash, because this means freedom and non-traceability, it is to be completely replaced by digital money in the long term - we all become transparent citizens or only consumers!

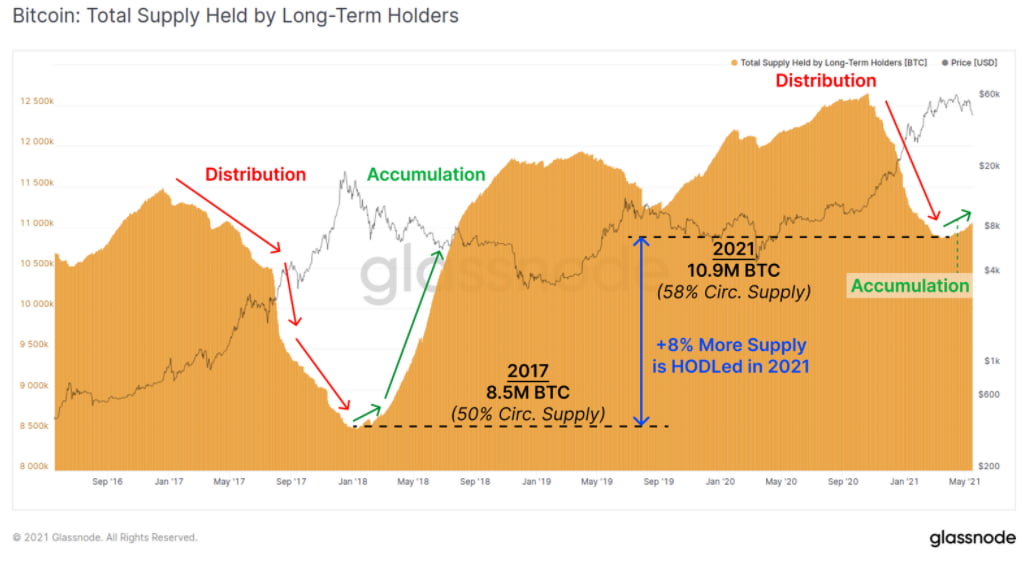

While private investors are selling their crypto holdings out of panic, institutional investors (professionals), on the other hand, are entering the market. Coinbase recently saw a higher inflow. The many large investors using the American exchange seem to see a suitable entry point at the moment and are stocking up their BTC holdings. A rogue who thinks evil of this.

Could the critical reports on cryptocurrencies have perhaps even been coordinated across borders in the end? Well that would now be a malicious insinuation, the world and especially the markets are influenced by so many different participants and players, but it is very surprising, because the profiteers now seem to be financial professionals who can enter or buy at a stroke 30-60% below the last highs. The small investors, on the other hand, who have sold in panic would now have to buy again much more expensive... I for my part will not sell, on the contrary I will now only really active, because this sign is a confirmation of my assessment. Bitcoin is becoming more and more of a problem for the trading upper class, the more successful, the more they come under pressure.

The question may seem a bit strange to one or the other reader, but let me explain it briefly. If you, like me, also belong to the group of "hodlers" who just want to collect cryptocurrencies over a long period of time, then you can not care about the current rates. Because the fact is, once you have collected a few units of a cryptocurrency, then you own it! You can trade them and also exchange them for other cryptocurrencies. Moreover, when the price is low, you can collect much more with the help of faucets or paid ads.

For example, the drop in the exchange rate has led to the fact that at Freebitco.in, a claim now yields 50% more Satoshis than before the bitcoin exchange rate drop. The reason for this is that the earning models in the background run on a US dollar basis (still). And when the US dollar rises to the bitcoin, you just get more bitcoin in return. The same game applies in reverse, of course, if the US dollar loses value against bitcoin.

Another argument why an adjusted exchange rate is not so bad is the fact that the enormous increase of the last few months has taken some pressure out of the kettle. Some speculators may now have been forced out of the market and, as with rapidly rising stocks, smaller setbacks are better and healthier in the longer term.

As the last few weeks and months have seen crypto stock market prices reach unbelievable heights and more and more people are becoming aware of the game that is being played, governments around the world are now being forced to act. We will certainly see further discussions about regulations and also certainly in some countries bans on cryptocurrencies. But what those in charge still don't seem to understand is that Bitcoin cannot be shut down or banned. The blockchain continues to work steadily, on all computers around the world. Once you have a few Satoshis, you can care less about the rate in fiat currency, because you don't need it anymore.

Bitcoin works decentralized, you can always send and receive bitcoin with your own wallet, you don't need the old money system anymore and therefore no central bank, it loses its status. The national currency loses its power status, the most democratic currency is and remains the Bitcoin, the super rich and the governments are afraid of that! So stay cool, just hodle on and use price setbacks to possibly buy more or increase the activity in collecting. We are sure: Your strategy should be long-term oriented (over several years), only then you will emerge as a winner.

Just think of the enthusiasts of the first hour, did they sell immediately at larger setbacks? Today you laugh about a few percent loss or profit, the true price of Bitcoin you determine for yourself, how important are independence and freedom to you? Correct: These values are priceless!

<< Actual top crypto news stories - May 2021El Salvador wants Bitcoin as official means of payment >>