2021-08-08

From now on, Ether (ETH) will be burned with every transaction. For Vitalik Buterin, one thing is certain: London shows that Ethereum is capable of significant change. Market Update.

At the end of the week, the crypto market shows its bullish side. However, the crypto lead currency Bitcoin (BTC) has once again launched an attack on USD 40,000 and prints a decent daily gain of 5.26 percent at USD 41,123 as of press time. The Ether price (ETH) is also still on the upswing. At USD 2,786, ETH is trading four percent above the previous day's level.

The London upgrade was carried out on block level 12,965,000. Its most important component is EIP-1559 (Ethereum Improvement Proposal), which brings drastic changes to Ethereum's fee model. Until now, Ethereum used an auction model where gas fees could be freely determined by the initiator of a transaction. Those who pay more have a greater chance of having their transaction included in a block by a miner. Ether blocks have a gas fee limit, meaning space is limited. In times of high network utilization, this had repeatedly led to significant spikes in gas prices.

With EIP-1559, not only was the gas fee limit of Ethereum blocks doubled to 25 million gas units, but a so-called base fee was also introduced. This base fee flexibly adjusts to the block utilization. If the gas fees in a block exceed the target value of 50 percent of the limit, the base fee per gas unit increases.

The kicker is that the base fee has a deflationary impact on Ether. Instead of flowing into the miners' wallets, the collected gas fees of a block are destroyed. Currently, the burn rate is 1.93 Ether per minute. In the last 24 hours (though London is not quite that old at press time), the network has burned an average of 2.89 ETH/min. At the time of writing, 4,162 Ether (ETH) have already been destroyed since London. At the current Ether exchange rate, that equates to about $11 million USD.

Even though thousands of Ether go into the virtual oven every day, miners do not have to do without a "tip." Thus, it is still possible to tip one's transaction to get it into a block faster.

That Ether mining is still profitable after the introduction of EIP-1559 is also suggested by a look at the hash rate. Data from CoinWarz shows a significant increase in the Ethereum hash rate after the London upgrade.

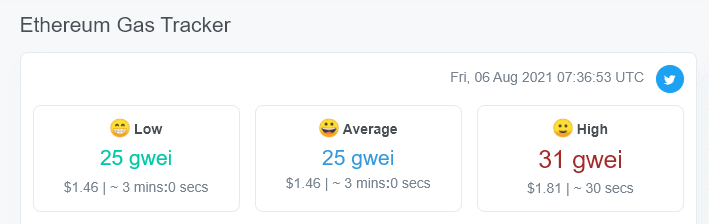

Gas fees have currently stabilized at a low level between 25 and 30 Gwei (Gigawei, equivalent to 0.000000001 ETH - a "nanoether").

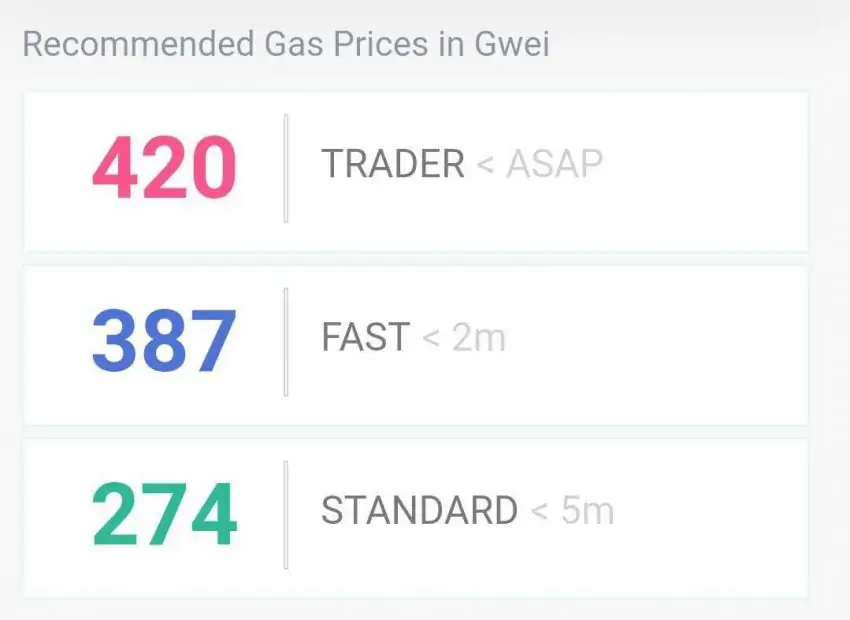

This looked quite different on the evening of August 6:

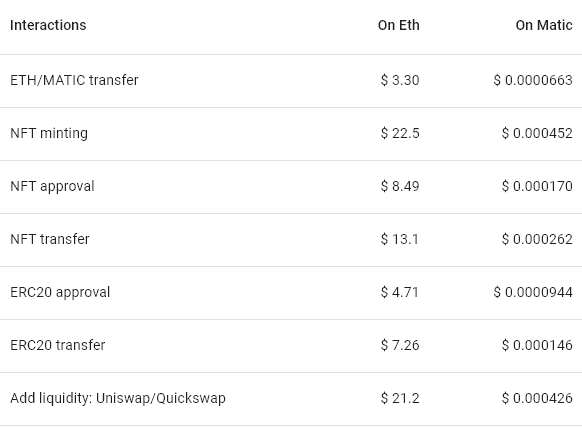

Even if the fees are currently at a low level: At 6th August evening showed that fluctuations are still possible. However, since the increased use of Layer 2 networks such as Polygon (MATIC) even before London, the problem of charges has eased considerably. In comparison, even the currently low Ethereum fees still look significantly more expensive than on its "Internet of Blockchains".

Meanwhile, Ethereum founder Vitalik Buterin has expressed his delight at the successful running of the London Hard Fork - also in view of the upcoming mammoth project, the move to proof-of-stake. Speaking to news portal Bloomberg Singapore on Thursday, Buterin said London was "proof that the Ethereum ecosystem is capable of making significant changes."

<< Bitcoin Faucet News July 202110 basic rules for Crypto Faucets (PDF Download) >>